Considering the economy slow down during the past couple of years due to several reasons like pandemics, wars and global recession and inflation, due to the economy instability for such a relatively long time, SMEs are struggling for survival, so could ERP be the saviour of the small and medium businesses, this will be discussed in this article, Keep reading.

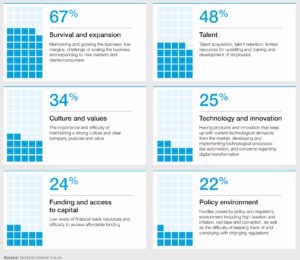

In a report released by World Economic Forum (WEF) in collaboration with the National University of Singapore shows that 67% of the world SMEs are fighting for survival due to several factors, one of them is that 75% of the world SMEs do not consider digital transformation and business automation to keep up with current market technological demands, along with other factors like talent acquisition, policy compliance and access to funds.

A survey, by McKinsey & Company, pointed out that SMEs spend significant time and expenses on non-core business activities. SMEs’ pain points are related to financial administration and time spent on financial administration or banking. These two expenses make up 25% of the average SME deposit balance. Adding IT expenses, the result goes up to 34%, which shows the significance of these non-core activities. Anything that can help reduce these will help SMEs a great deal.

SMEs cannot bear the long period economy slow down because of their sales small profit margin and lack of finance and access to funds. Financial institutes require historical transaction, and recognise the business process to assess business ability to sustain and grow at least during the finance period.

Could ERP be the saviour of small and medium businesses?

ERP benefit SMEs in several ways

- ERP keeps historical business records, not only enable power of data analytics to make effective decisions, also increase investors and financial institutes trust in the SME business.

- ERP issue digital and electronic invoices, to comply with government laws and regulation like e-invoice, plus enable access to some types of finance facilities like invoice factoring.

- ERP automate and organise your business by defining the internal processes which save SMEs time and effort and as a result customer satisfaction, which increase customers trust, and sales.

- Cloud ERP enable SMEs fast track to digital transformation to satisfy current market needs, from digitalisation, and accept online payment.

- ERP comes with pre-defined processes and knowledge, employees may increase their skills level and knowledge during the ERP implementation phase, this may overcome talent acquisition problem and lack of financial and administration skills.

iX ERP Cloud solution address the issues that SMEs face, to be able to be sustainable, overcome market issues, and access to finance to be able to survive during the current hard economy.